Special thanks to Ana Belén, Don Pepe, Abraham FuGa and Celic Torres for the feedback and the review.

TL;DR

Mexico is among Latin America's fastest-growing crypto markets, ranking 13th-14th globally in adoption, driven by a unique combination of high remittance flows ($64.7B in 2024), financial inclusion needs, and a young tech-savvy population.

The U.S.-Mexico remittance corridor, the world's largest, has become a proving ground for crypto innovation. Platforms like Bitso processed over $6.5 billion in crypto-based transfers in 2024, representing more than 10% of total corridor volume.

Mexico's Ethereum community is rapidly maturing, with growing university blockchain clubs, developer education initiatives reaching students, institutions and governments integrating Ethereum and emerging local projects focused on DeFi, stablecoins, and cross-border payments.

The Economic Foundation: Remittances as Catalyst

Mexico stands as the world's second-largest recipient of remittances after India, with $64.7 billion received in 2024, roughly 3.7% of the nation's GDP. These transfers are a critical lifeline for millions of households, especially in poorer states.

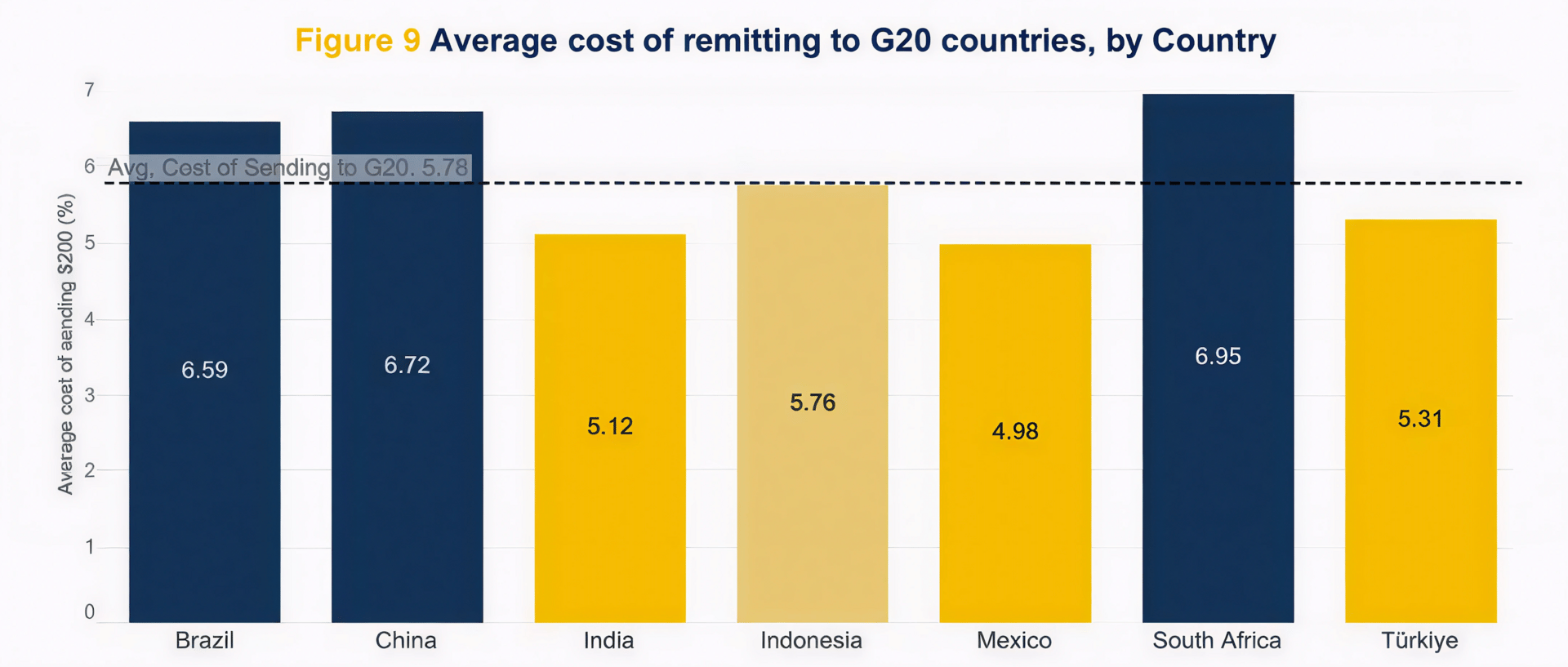

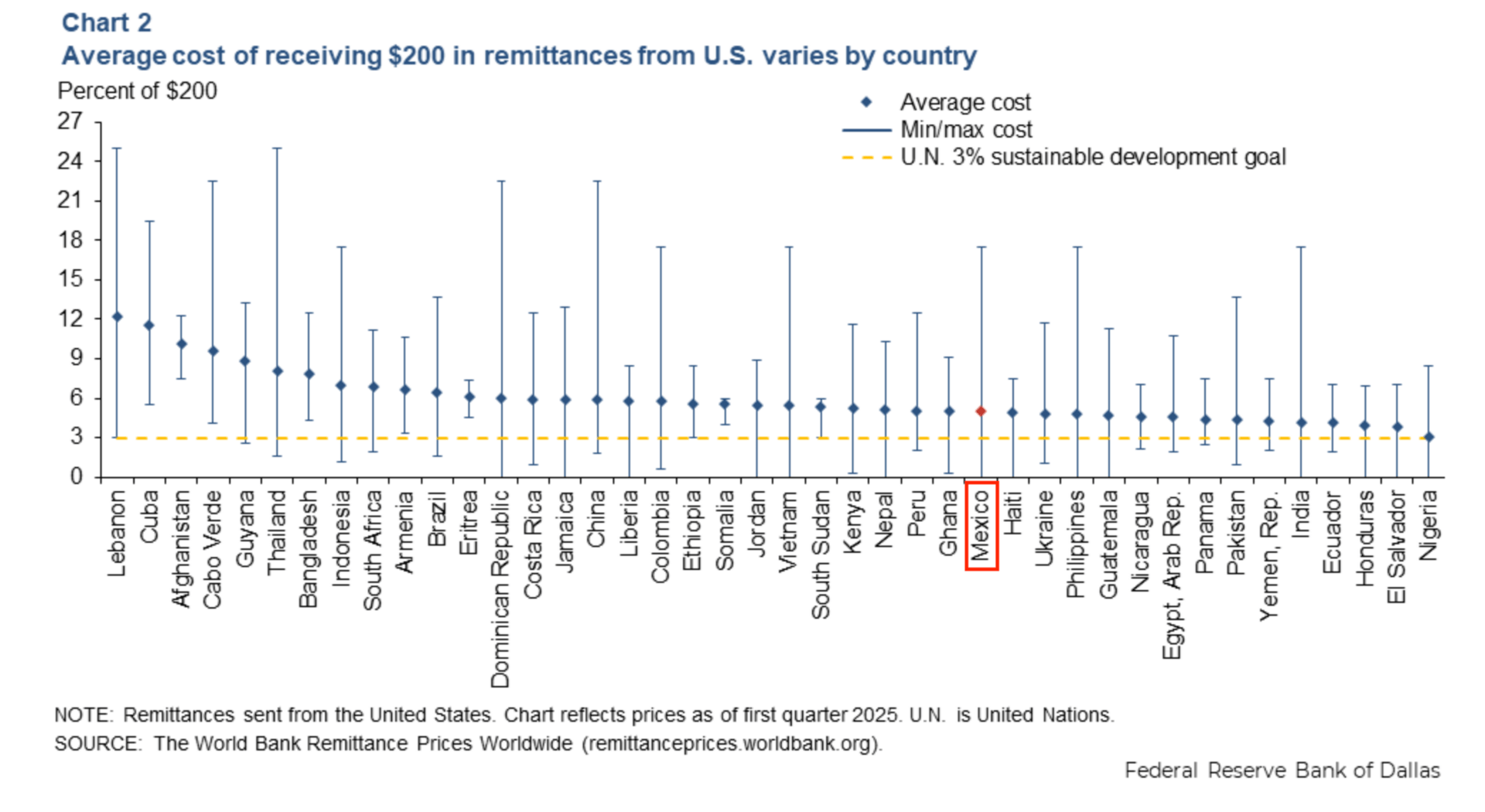

The U.S.-Mexico corridor dominates global remittance flows, and the cost of sending money has historically been high. Traditional channels charge slightly below 5% for a $200 transfer. This inefficiency has created massive opportunity for crypto-based alternatives.

Crypto has emerged as a cost-effective solution, with stablecoin transfers costing as little as ~$0.02 on-chain (depends on the network and can fluctuate based on network activity), though total fees (including conversion to local currency) typically range from 0.5-3% depending on the corridor and platform. For example, Bitso processed $3.3 billion in remittances from the U.S. to Mexico in 2022 with transaction fees of less than 1%, up from $2 billion in 2021. Stablecoins like USDT and USDC have become the most practical vehicles for these transactions, offering dollar stability without the volatility of traditional crypto.

Financial Inclusion Gap

Approximately 45% of Mexican adults lack access to traditional banking services, according to various estimates. This massive unbanked population represents both a challenge and an opportunity for blockchain-based financial services. For many Mexicans, crypto wallets provide their first real access to digital financial infrastructure.

The combination of high remittance volumes, significant financial exclusion, and tech-savvy youth has made Mexico fertile ground for crypto adoption as practical financial infrastructure, not just a speculative asset.

Regulatory Landscape: Conservative Framework, Innovative Workarounds

Mexico was a regional pioneer with its 2018 Fintech Law (Ley para Regular las Instituciones de Tecnología Financiera), one of Latin America's first comprehensive frameworks for digital financial services.

Key Regulatory Features

Legal but Not Legal Tender: Virtual assets are legally recognized under the Fintech Law but explicitly not considered legal tender.

Banking Restrictions: In 2019, Banco de México (Banxico) issued Circular 4/2019, effectively prohibiting financial institutions (banks and regulated fintechs) from offering crypto services to the public. They can only conduct "internal operations" with virtual assets, and only after obtaining prior authorization from Banxico.

Non-Financial Entity Space: The regulations created an opening for non-financial entities (like Bitso) to operate exchanges and custody services, subject to strict Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

Taxation: As of 2025, Mexico has not yet implemented a dedicated tax framework for crypto-assets. Crypto profits are subject to income tax (up to 35% for individuals, 30% for corporations). Capital gains under 90,000 pesos may be tax-exempt.

Tax Treatment, Clear Obligations, Unclear Execution

Mexico’s Constitution requires all residents to contribute taxes proportionally and equitably. However, no comprehensive framework defines how crypto is categorized, what events are taxable, or how reporting should occur.

As a result, both individuals and institutions face interpretative uncertainty.

Common classification proposals include:

Intangible asset (most aligned with international practice)

Merchandise

Investment

Money substitute (least applicable under Fintech Law)

In 2021, the Federal Taxpayer Advocacy Office published a non-binding technical note addressing only crypto sales. It offered no guidance for mining, staking, airdrops, or DeFi and lacks legal weight.

A major operational barrier is the incompatibility between crypto transactions and CFDI, Mexico’s mandatory electronic invoicing standard. CFDIs require identifiable counterparties, physical addresses, peso-denominated prices, and logged payment methods, conditions that decentralized crypto transactions often cannot satisfy.

As a result, taxpayers face uncertainty about valuation, documentation, and compliance, pushing many entrepreneurs and developers to structure activity abroad.

CBDC Development

In 2021, Banxico first announced plans to issue a Mexican peso Central Bank Digital Currency (CBDC) by 2024 to promote financial inclusion, but progress has stalled and updates remain scarce. In April 2024, Banxico joined the BIS-led Project Agorá to explore tokenized deposits and wholesale digital money for cross-border payments. The project is experimental and aims to report initial findings by the first half of 2026.

Regional and Governmental Innovation

Despite the lack of top-down national policy, subnational governments and legislative bodies have begun experimenting with blockchain technology, especially using Ethereum and ZK-based infrastructure for transparency, identity, and citizen-service use cases.

Nuevo León:

The state, Mexico’s second-largest economy and a leading technology hub, has launched NLinea, a Decentralized Digital Identity (DID) platform for citizens. Built on Sovra, a blockchain developed with the Ethrex stack on Ethereum, NLinea creates a verifiable, privacy-preserving digital ID system to streamline access to public services and reduce fraud.

Mexico City & Other Regions:

The Cámara de Diputados (Chamber of Deputies) has hosted a series of educational sessions, policy roundtables, and public forums focused on blockchain’s potential for transparency, procurement, and digital governance.

Market Dynamics: Adoption Beyond Hype

Scale of Adoption

User Base: Estimated 15 million crypto users by 2025, representing 10.1-12% of Mexico's population (129.7 million)

Demographics: 37% of crypto investors are aged 25-34, with 22% each in the 18-24 and 35-44 age groups. 74% of users are men, 26% women

Local Stablecoins

In recent years, multiple projects have launched Peso-pegged stablecoins (MXN-backed) to bridge Mexico’s traditional financial system with onchain liquidity. These tokens aim to enable faster cross-border payments, remittances, and yield-bearing DeFi products denominated in the local currency.

Arbitrum x Bitso – MXNB

A collaboration between Bitso (the leading LATAM exchange) and Arbitrum to launch MXNB, a peso-backed stablecoin fully collateralized 1:1 with MXN. MXNB aims to facilitate onchain payments, payroll, and remittances, leveraging Bitso’s fiat rails and Arbitrum’s scalable infrastructure.

Etherfuse introduced MXNe on Coinbase’s Layer-2 Base (as well as Solana and Stellar), combining local-currency exposure with institutional compliance. The token is designed for on-chain payments, remittances, and payroll

Tether (MXNT)

Launched in 2022 as Tether’s expansion into emerging markets. Despite Tether’s brand strength, MXNT adoption remains small, largely due to limited DeFi integrations and preference for USD-pegged liquidity pairs.

Use Cases

Remittances: The killer app. Crypto-based transfers are faster and cheaper than Western Union or wire transfers. Bitso alone processed over $6.5 billion in remittances in 2024, which is more than 10% of the total U.S.-Mexico corridor.

Dollar Access: Stablecoins provide a way to hold dollars without relying on banks that may impose currency controls or unfavorable exchange rates during volatile periods. During the pandemic, crypto markets acted as efficient forex markets when banks had enormous spreads.

Freelance & Remote Work: Mexico's tech workforce increasingly receives compensation in crypto, especially stablecoins, from global clients. This is particularly common among developers and digital professionals.

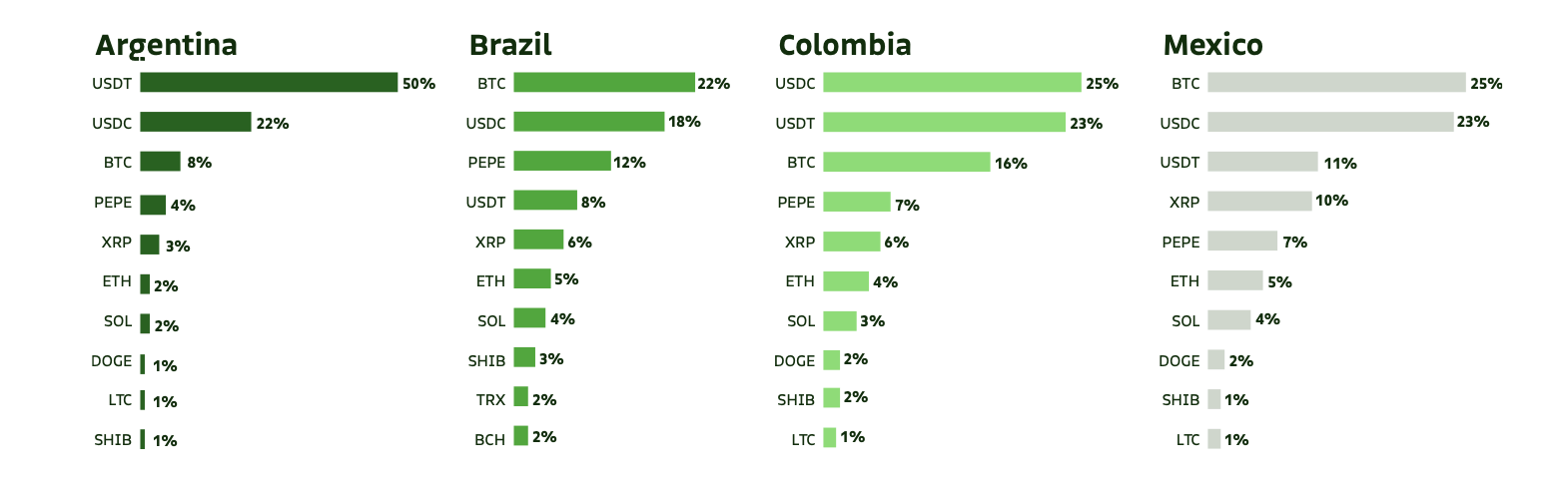

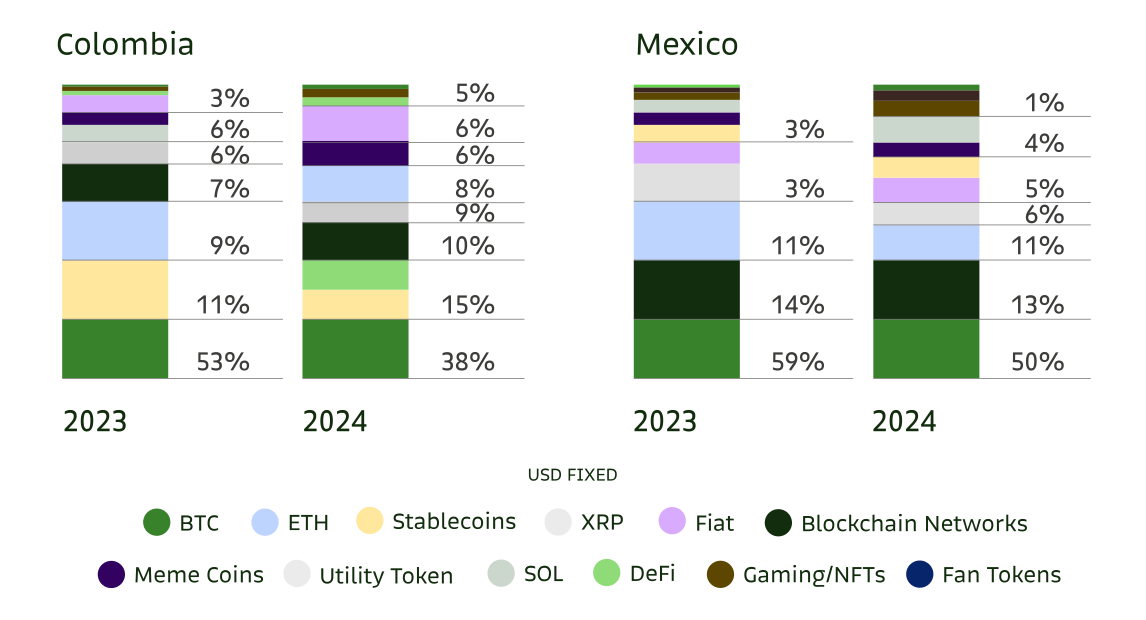

Investment & Trading: Beyond utility, many Mexicans use crypto for speculation and portfolio diversification. Bitcoin remains the most held asset (~50% of portfolios), but stablecoins captured 34% of purchases in 2024 (up 6% YoY).

Advertisement

Choose the Right AI Tools

With thousands of AI tools available, how do you know which ones are worth your money? Subscribe to Mindstream and get our expert guide comparing 40+ popular AI tools. Discover which free options rival paid versions and when upgrading is essential. Stop overspending on tools you don't need and find the perfect AI stack for your workflow.

Startup Ecosystem

1. Infrastructure: Exchanges and On/Off Ramps

Bitso: The Dominant Player. Founded in 2014 and headquartered in Mexico City, Bitso stands as Mexico's largest crypto exchange, and the first crypto unicorn in Latin America, establishing a major presence across the region with operations in Brazil, Argentina, and Colombia. By the end of 2024, the platform reported approximately 9 million retail clients across Latin America, with 4.4 million of those users based in Mexico.

Binance: Popular for international trading but faces regulatory scrutiny. Binance launched Medá on Sept. 1, 2025, a Mexico-based Electronic Payment Funds Institution (IFPE) fintech expanding peso deposits and withdrawals to connect traditional finance with its crypto ecosystem and boost financial inclusion.

Trubit: Mexican exchange.

Payment Rails: Mexico's SPEI (Sistema de Pagos Electrónicos Interbancarios) is Mexico’s critical real-time rails. It’s operated by Banco de México, runs 24/7, and processes near-instant interbank transfers.

Note: SPEI integration is regulated. Most of the crypto projects or fintech usually offer instant MXN deposits/withdrawals via partner banks or licensed PSPs that are the actual SPEI participants.

2. Payment and DeFi Startups

Dollar App: On/Off ramp, Remmitances, global payments and credit card.

Bando: Bando is a stablecoin payment protocol that connects crypto with traditional financial services, reducing the gap between the two.

Capa: Capa simplifies global payments, enabling companies to move money across borders via stablecoins fast, cost-effective, and fully compliant.

Monato is a fintech company building payment rails. Empowers businesses to automate payments, deposits, transfers, credit operations, and business intelligence through a single, unified API.

Meta Pool: Staking and Liquidity Provider Protocol.

Rio Trade: Trading and TX platform.

Cash Abroad.- On/off ramp platform.

Maya Protocol: Crosschain liquidity: Decentralized swapping experience across multiple blockchains

Chipipay: The payment SDK that allows building invisible wallets and payment experiences.

Dollar App: On/Off ramp, Remmitances, global payments and credit card.

Revert Finance: Analytics for AMM liquidity providers.

Moca: Multichain Wallet.

Rancho Stake: A Mexico/LatAm community-run Ethereum staking collective operating 100+ validators with 20+ home-staking operators using multi-operator clusters (Obol/SSV, often on Dappnode).

Grassroots & Community: Growing but Early Stage

Developer Scale & Momentum

Mexico has approximately 1.9 million developers with 21% YoY growth in 2024, making it one of the fastest-growing dev communities in Latin America. While the blockchain-focused subset remains small compared to Brazil, momentum is accelerating through university clubs, regional hacker houses, and builder collectives.

International Contributions: Mexican builders are actively contributing to global Ethereum projects including Ethereum Foundation (All Core Devs), Arbitrum, Optimism, Uniswap, Base, and others, strengthening Mexico's presence in the broader Web3 ecosystem.

Community Infrastructure

Mexico's Ethereum community has grown education-first and grassroots, driven by university students, Spanish-language creators, and regional organizers rather than top-down VC funding.

Ethereum México: An organization dedicated to promoting Ethereum adoption, education, and events in Mexico. It organizes University Blockchain Days, Builders Days, events with Fintech organizations and the yearly flagship conference and hackathon, ETH México.

Regional Nodes: Regional chapters: Ethereum Monterrey (infrastructure/enterprise) and Ethereum Veracruz (university-focused).

Others:

Content & Education: Espacio Cripto runs Latin America's leading Spanish blockchain podcast.

Builders: Frutero organizes technical workshops. ETH Cinco de Mayo organize hackathons. HERDAO Mexico drives female participation. CryptoUNAM anchors activity at Mexico's top university. Mexico Tech Week is one of Mexico City’s largest tech events, attracting local Web3 builders and hackers.

Institutional: Bitso's Stablecoin Conference bridges grassroots builders with institutional players.

Highlighted Education Initiatives

Leading Mexican universities are introducing blockchain education, though most programs remain introductory. Notable initiatives include:

UNAM offers faculty courses through FCA Educación Continua, while student club CriptoUNAM drives campus workshops. Tecnológico de Monterrey pioneered blockchain-secured diplomas and offers online programs. ITAM runs executive courses on blockchain applications with detailed public syllabi. These institutions also serve as key target schools for Web3 hiring.

Universidad Veracruzana stands out as the birthplace of Ethereum Veracruz (led by CJ Valdez), offering hands-on courses in DApps and smart contracts alongside regular student hackathons.

The gap: Most programs focus on awareness over technical depth. Mexico lacks advanced protocol development or cryptography specializations comparable to Stanford or MIT programs, though student-led communities are filling this void through builder-focused events and hands-on learning.

Challenges

Outdated Regulatory Framework

The main challenge for the Ethereum ecosystem in Mexico is regulatory uncertainty that creates an operational limbo where cryptocurrencies are legal under the 2018 Fintech Law but operationally restricted by Banxico's Circular 4/2019 which prohibits banks from offering crypto services. This ambiguity extends to the tax realm, generating a domino effect where entrepreneurs incorporate startups in other jurisdictions, developers work remotely for foreign companies capturing value outside Mexico, vulnerable users lack government education violating the constitutional right of Article 3, and the banking system remains completely disconnected from the crypto ecosystem creating two parallel financial universes. All this occurs while the world's largest remittance corridor with 64.7 billion dollars annually represents a massive opportunity where Bitso already processes 6.5 billion through crypto with fees below one percent versus the traditional five percent, demonstrating the transformative potential that could be scaled with a clear regulatory framework that balances innovation with consumer protection.

MXN Stablecoin Liquidity

Multiple peso-pegged tokens exist (MXNB, MXNe, MXNT), but onchain depth and integrations are limited. Without liquid MXN pairs, remittances and DeFi rails stay USD-dominated.

Restricted Access to Payment Rails

SPEI, Mexico’s instant payment system, is crucial but heavily regulated. Most exchanges rely on partner PSPs instead of direct integration, slowing fiat on/off-ramps.

Fragmented Ecosystem & UX Friction

Liquidity is spread across L2s, wallets remain complex, and gas fees confuse new users.

Limited Institutional Connectors

Few professionals can bridge regulators, banks, government and DeFi builders. This slows pilot projects and policy alignment that could unlock larger adoption.

Conclusion

Mexico's crypto ecosystem has evolved far beyond speculation, it's become critical financial infrastructure. The remittance corridor created the use case, stablecoins provided the rails, and L2s made it economically viable. What began as a workaround for expensive Western Union transfers is now a testing ground for the future of programmable money.

The next phase hinges on three catalysts: regulatory clarity that enables rather than restricts, MXN stablecoin liquidity that makes peso-denominated DeFi practical, and a maturing developer community that builds for local needs. Mexico isn't following the crypto playbook written elsewhere, it's writing its own, shaped by remittances, financial exclusion, and a generation that sees blockchain as infrastructure, not ideology.

Further Reading

Mexico’s Blockchain and Cryptocurrency Laws and Regulations in 2026 by Global Legal Insights

Mexico’s Crypto Economy: More Than Just Remittances by Crypto Council for Innovation

Innovation promises efficiencies in remittances, if regulation can keep up by Federal Reserve Bank of Dallas

❤️❤️❤️

Love Local Ethereum? Please Share.

Have any comments or feedback? Please DM.

If your company is interested in reaching an audiences of regional community and ecosystem builders, developer communities, universities, startup partners, or policymakers, you may want to advertise with us.